The Benefits of a Buy-Sell Agreement

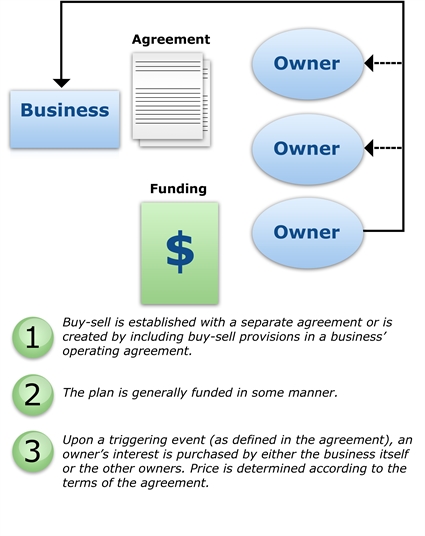

A buy-sell agreement is a legally binding contract in which the owners of a business set forth the terms and conditions of a future sale or buy back of a departing owner's share of the business. Specifically, buy-sells control when owners can sell their interests, who can buy an owner's interest, and at what price.

Buy-sells can accomplish many objectives, but are primarily used to ensure the smooth continuation of a business after a potentially disruptive event, such as an owner's retirement, incapacity, or death.

Also valuable estate planning tools, buy-sells can provide for the orderly succession of a family business, and for the liquidity needed for payment of a deceased owner's estate settlement costs and taxes. Further, if structured properly, a buy-sell can establish the purchase price as the taxable value of an owner's business interest, avoiding unexpected estate tax consequences at the owner's death.

Who Should Consider a Buy-Sell Agreement?

- Business owners who do not want to be forced to work with or share control of the business with a stranger who buys an interest from a departing owner

- Business owners who do not want to be forced to work with a spouse or other family member of a deceased or divorced co-owner

- Business owners who do not want to end up co-owning the business with a bankruptcy trustee or creditor if a co-owner experiences personal financial difficulties

- Business owners who do not want their heirs to inherit a business for which they cannot get a fair price

- Business owners who do not want to engage in pricing disputes with heirs of deceased co-owner

Funding a Buy-Sell Agreement with Life Insurance

When using life insurance with a buy-sell agreement, either the company or the individual co-owners buy life insurance policies on the lives of each co-owner (but not on themselves). If the owner were to die, the policyowners (the company or co-owners) receive the death benefits from the policies on your life. That money is paid to your surviving family members as payment for your interest in the business. If all goes well, the deceased's family gets a sum of cash they can use to help sustain them after the owner's death, and the company has ensured its continuity.

The Importance of Reviewing Buy-Sell Agreements

What is often overlooked is the periodic review of Buy-Sell plans, especially confirming that adequate funding is in place using the most cost-effective insurance products. Insurance products often change and evolve, and what was put into place years ago may no longer be the most favorable option.

The buy-sell agreement should be fully funded

As an owner, the amount of insurance coverage on your life should equal the value of your ownership interest. Then, when you die, there will be enough cash from the policy proceeds to pay your family or estate in full for your share of the business. But if all that is affordable is insurance coverage for a portion of your interest, you might want to go ahead and fund that amount. Later, the company may be able to increase the amount of insurance or use additional funding methods. In the meantime, the agreement should specify how your family or estate will be paid.

The value of the business could change over time

What if the insurance proceeds turn out to be less than the value of your business interest, due to growth in the business? Your surviving family members might end up getting less than full value for your business interest. Your buy-sell agreement should specify how the valuation difference will be handled.

Conversely, the insurance proceeds might be greater than the value of your business interest when you die. Your buy-sell agreement should address this potential situation upfront and specify whether the excess funds will belong to the business, the surviving co-owners, or your family or estate.

Contact Us with Questions

If you are a business owner and have questions about your succession plan, or are a professional partner with questions about how this may apply to a client, we would welcome the opportunity to work with you. Please call us at the office or schedule a time here.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.